A promissory note is a written agreement for the repayment of a loan. It’s a commitment to pay and entails all the details of the promise. A bank can issue a promissory note, but it can also be issued by a person, a corporation, a business, or someone giving loans.

Although a promissory note is not really a contract, you will likely be required to sign it with CocoSign before taking out a loan.

What is a Promissory Note, and How Does It Work?

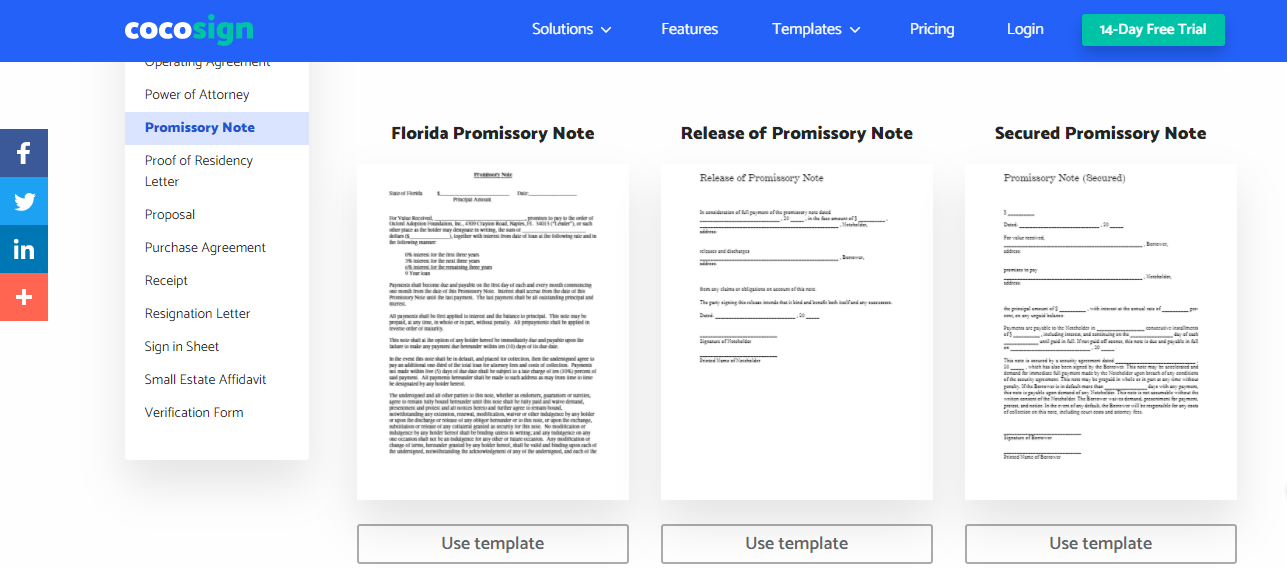

There are two types of promissory notes: secured and unsecured. A loan issued only on the maker’s ability to pay back is referred to as an unprotected promissory note. A secured promissory note is one in which the loan is backed by a valuable asset, such as a home.

These notes are legally binding documents. If the debtor fails to comply with the deal and the loan balance conditions, the provisionary notes may be sued.

Promissory Notes Come in a Variety of Types

Promissory notes come in a variety of shapes and sizes. The differences are based on the type of debt and the details contained in the note:

- Personal or informal: This type of communication could be sent from one family member or acquaintance to another.

- Commercial: These notes are more official and detail the terms of the loan. This promissory note is associated with a home loan or other commercial property purchase.

- Investment: A corporation can raise funds by issuing a promissory note, which can then be resold to other shareholders. Only experienced investors with the necessary means should take on the risks associated with these notes.

Based on how the debt is to be returned, promissory notes may also differ:

- Lump-sum repayment: The total loan balance is repaid all at once.

- Due on demand: When the lender demands repayment, the debtor must pay the debt on request.

- Installment: How the loan is repaid is determined by a predetermined payment schedule.

- Interest-bearing (or non-interest-bearing): The rate of interest, if any, should be specified in the contract.

When Should a Promissory Note Be Used?

Mortgages, school loans, vehicle loans, company loans, and consumer lending between loved ones are all examples of promissory notes. You may wish to create a promissory note from CocoSign if you are lending a big sum of money to anyone (or a company).

This note will serve as a court record of the payment, protecting you and ensuring that you get paid. You can get these templates quickly from CocoSign simply after creating an account. To visit the official page of CocoSign, click here.

CocoSign is a well-known brand that is used in about 190 countries throughout the world. CocoSign is a standard template library that includes all leases, promissory notes, agreements, and personal and business use contracts. Its prominence and great solutions have been recognized in various major sites, including Forbes and the New York Times.

You can free promissory note template online on CocoSign anytime & customize them as well according to your needs, i.e., if you are lending money for business or personal use.

Promissory Notes Requirements

Every country has its own regulations governing the basic features of a promissory note, but they all have to include the following:

- The provider is the individual who is responsible for the debt and pledges to pay it back.

- The lender, or the related person lending the money, is the payee.

- The start date of the repayment commitment.

- The amount of interest identifies the actual value of the borrowed funds by the payor.

- The interest rate is as follows: Usually, the rate of interest levied is mentioned. It could be basic interest, interest earned or another kind of interest calculation.

- The first payment is due on the following date: The payment to be paid monthly along with the monthly timeframe, followed by the first day of each succeeding month until the debt is paid off.

- The promissory note’s due date is: This date can be the final payment of an annualized debt that is paid off in a sequence of installments on a set date or an interest amount, which makes the total outstanding sum due on a particular day.

Important Points to Remember

A promissory note is a simple document that can be beneficial in the following situations:

You’re pledging to pay a specific, low-dollar amount, and the transaction is low-risk.

Promissory notes provide some security to the person who is owing money. As a result, where security is needed a full loan agreement may be necessary instead.

When you add more complicated provisions to a promissory note, it becomes a more complicated financial product and falls under the jurisdiction of specific rules. In these cases, you should have your promissory note reviewed by a lawyer to confirm that it is acceptable for your condition.

Article by Born Realist